Bankruptcy Attorney Tulsa: Understanding Exemptions And Non-dischargeable Debts

Table of ContentsTulsa, Ok Bankruptcy Attorney: A Lifeline In Challenging TimesBankruptcy Attorney Tulsa: The Process Of Creditor Claims In BankruptcyBankruptcy Lawyer Tulsa: How To Handle Student Loan Debt In BankruptcyThe Emotional Aspects Of Bankruptcy: Support From Tulsa Bankruptcy Attorneys

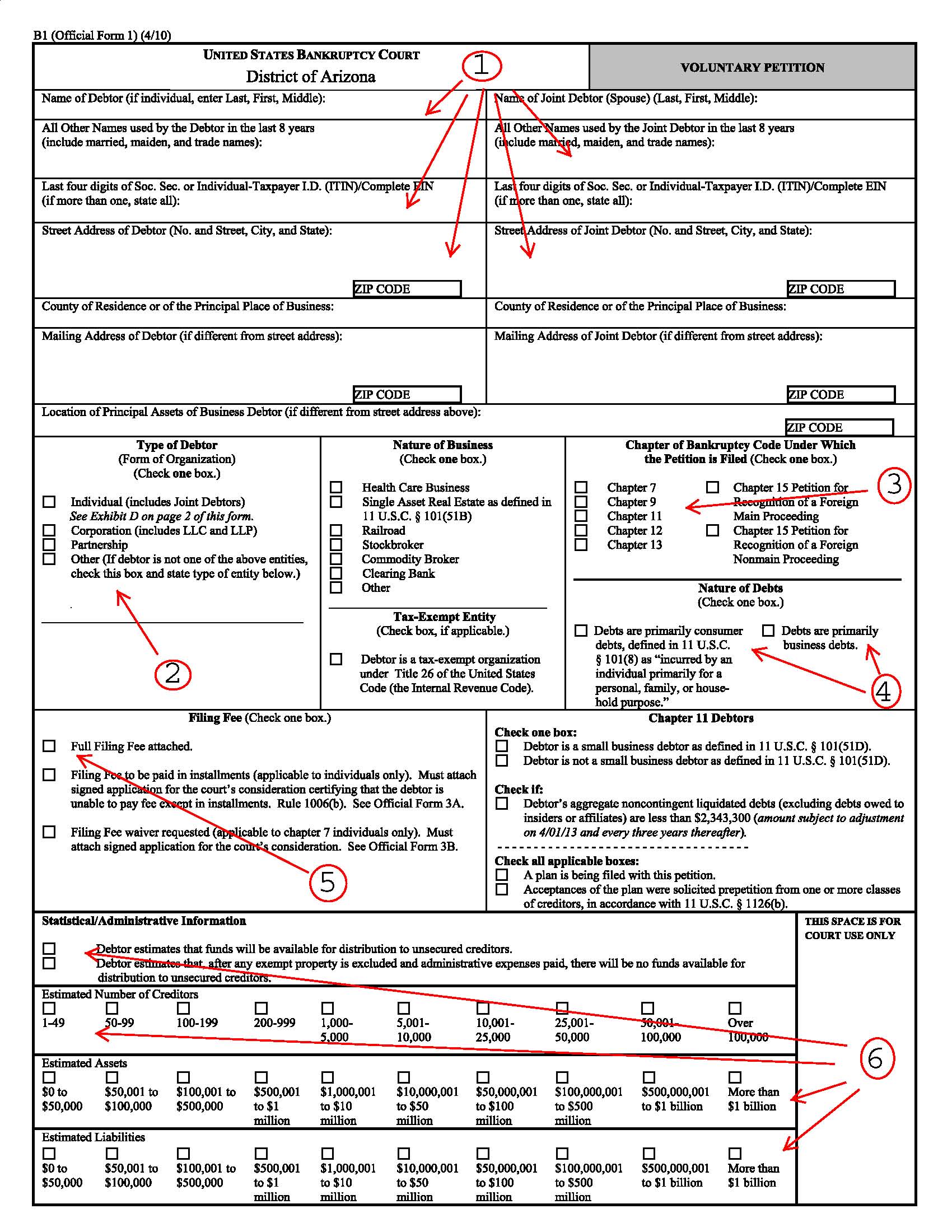

It can harm your credit scores for anywhere from 7-10 years as well as be a barrier towards obtaining security clearances. If you can not solve your issues in less than five years, insolvency is a feasible choice. Lawyer costs for insolvency differ depending on which develop you pick, exactly how complex your situation is and also where you are geographically. bankruptcy lawyer Tulsa.Various other bankruptcy prices include a filing cost ($338 for Chapter 7; $313 for Phase 13); and costs for credit therapy as well as monetary monitoring programs, which both cost from $10 to $100.

You do not always require a lawyer when filing private insolvency on your very own or "pro se," the term for representing on your own. If the situation is easy enough, you can file for insolvency without aid. Yet most individuals gain from representation. This write-up discusses: when Chapter 7 is too complicated to handle yourself why hiring a Chapter 13 lawyer is constantly crucial, and if you represent yourself, how a bankruptcy request preparer can assist.

The general rule is the simpler your bankruptcy, the better your chances are of finishing it on your own and receiving an insolvency discharge, the order erasing financial debt. Your case is most likely easy enough to deal with without a lawyer if: However, even straightforward Chapter 7 cases need work. Strategy on filling up out considerable documents, collecting financial documents, investigating insolvency and exemption legislations, and complying with neighborhood guidelines as well as treatments.

Bankruptcy Attorney Tulsa: How To Rebuild Your Credit Post-bankruptcy

Here are 2 circumstances that always call for representation. If you possess a local business or have revenue above the mean degree of your state, a significant amount of possessions, top priority financial obligations, nondischargeable financial debts, or financial institutions who can make claims versus you based on fraud, you'll likely desire an attorney.

Filers don't have an automatic right to disregard a Chapter 7 case. If you make a mistake, the bankruptcy court can toss out your situation or sell assets you thought you can maintain. You can additionally face a personal bankruptcy lawsuit to establish whether a financial debt shouldn't be discharged. If you shed, you'll be stuck paying the debt after bankruptcy.

Filers don't have an automatic right to disregard a Chapter 7 case. If you make a mistake, the bankruptcy court can toss out your situation or sell assets you thought you can maintain. You can additionally face a personal bankruptcy lawsuit to establish whether a financial debt shouldn't be discharged. If you shed, you'll be stuck paying the debt after bankruptcy. You may wish to submit Chapter 13 to catch up on home loan debts so you can keep your home. Or you may wish to eliminate your 2nd home loan, "pack down" or decrease a vehicle financing, or go right here pay back a financial debt that won't vanish in bankruptcy with time, such as back Tulsa bankruptcy attorney tax obligations or support debts.

You may wish to submit Chapter 13 to catch up on home loan debts so you can keep your home. Or you may wish to eliminate your 2nd home loan, "pack down" or decrease a vehicle financing, or go right here pay back a financial debt that won't vanish in bankruptcy with time, such as back Tulsa bankruptcy attorney tax obligations or support debts.In several situations, a personal bankruptcy legal representative can swiftly recognize problems you could not spot. Some individuals file for bankruptcy because they do not comprehend their options.

Tulsa Bankruptcy Attorney: How To Manage Bankruptcy And Mortgage Debt

For most consumers, the logical selections are Phase 7 as well as Chapter 13 personal bankruptcy. Tulsa bankruptcy attorney. Chapter 7 could be the method to go if you have reduced revenue as well as no possessions.

Preventing documents pitfalls can be problematic even if you choose the appropriate chapter. Right here prevail concerns bankruptcy legal representatives can prevent. Bankruptcy is form-driven. You'll need to complete a lengthy government package, and, sometimes, your court will certainly likewise have neighborhood forms. Numerous self-represented personal bankruptcy borrowers don't file every one of the called for personal bankruptcy records, and also their situation gets disregarded.

You do not lose everything in personal bankruptcy, yet maintaining building relies on understanding how residential or commercial property exceptions job. If you stand to shed beneficial property like your home, automobile, or various other building you appreciate, an attorney might be well worth the cash. In Phases 7 as well as 13, bankruptcy filers should get credit report counseling from an approved service provider prior to submitting for insolvency as well as finish a financial administration course prior to the court provides a discharge.

Many Chapter 7 situations move along predictably. You declare bankruptcy, participate in the 341 meeting of financial institutions, and also obtain your discharge. Not all personal bankruptcy cases continue efficiently, as well as various other, more complicated problems can occur. Numerous self-represented filers: do not comprehend the value of activities and also enemy actions can't effectively protect versus an action seeking to deny discharge, and also have a difficult time conforming with complex bankruptcy treatments.

Bankruptcy Attorney Tulsa: The Top Questions To Ask Before Hiring

Or another thing might appear. The bottom line is that a lawyer is vital when you discover yourself on the obtaining end of a movement or claim. If you decide to submit for insolvency on your own, learn what services are readily available in your district for pro se filers.

, from sales brochures explaining affordable or totally free services to comprehensive details concerning insolvency. Look for a bankruptcy book that highlights circumstances calling for a lawyer.

You have to accurately submit numerous kinds, study the legislation, and also go to hearings. If you recognize insolvency law yet would such as help finishing the types (the average insolvency request is approximately 50 pages long), you might consider hiring an insolvency application preparer. A personal bankruptcy petition preparer is anyone or organization, aside from a lawyer or somebody who helps a lawyer, that charges a charge to prepare personal bankruptcy papers.

Due to the fact that personal bankruptcy request preparers are not lawyers, they can not supply legal recommendations or represent you in insolvency court. Specifically, they can not: inform you which kind of bankruptcy to file inform you not to list specific financial obligations inform you not to provide particular properties, or tell you what building to excluded.

Due to the fact that personal bankruptcy request preparers are not lawyers, they can not supply legal recommendations or represent you in insolvency court. Specifically, they can not: inform you which kind of bankruptcy to file inform you not to list specific financial obligations inform you not to provide particular properties, or tell you what building to excluded.